If you are too deep into debt, can credit card consolidation help you to get out of it? The answer to this is yes, but, you will also be required to make sure that you are going to change you have been spending money, and using your credit cards. Credit cards make shopping easy, as you need not carry cash, and even if you are having cash crunch, credit cards help you buy things of your choice, as per your needs. However, this again leads you into debt, as you may not be able to pay down the money charged through the credit card. You can learn more here about credit card consolidation and how exactly it will help you.

If you are too deep into debt, can credit card consolidation help you to get out of it? The answer to this is yes, but, you will also be required to make sure that you are going to change you have been spending money, and using your credit cards. Credit cards make shopping easy, as you need not carry cash, and even if you are having cash crunch, credit cards help you buy things of your choice, as per your needs. However, this again leads you into debt, as you may not be able to pay down the money charged through the credit card. You can learn more here about credit card consolidation and how exactly it will help you.

Source: ccardzone.com

Video: Get Out of Debt Now! ? Penn Point

Should Christians Give While Getting Out of Debt? (Free Money Finance)

Any information shared on Free Money Finance does not constitute financial advice. The Website is intended to provide general information only and does not attempt to give you advice that relates to your specific circumstances. You are advised to discuss your specific requirements with an independent financial adviser. Per FTC guidelines, this website may be compensated by companies mentioned through advertising, affiliate programs or otherwise. All posts are ? 2005-2012, Free Money Finance.

Source: freemoneyfinance.com

Get Out of Credit Card Debt Lower Monthly Payments Reduce Balances

Does this sound familiar? You just got paid, your credit card payments are due, your bank account is low from paying your car payment and utilities. Your credit card balances are maxed out and you only have enough money to make the minimum payments. Both your gas tank and your refrigerator are empty and it?s another two weeks until the next payday. What do you do? Like more than 50% of Americans who can?t get out of credit card debt, you wipe out your bank account just to pay your minimum credit card payments, then you use what little available credit limit you freed up to put gas in your car and food on the table. This leaves you with maxed out credit cards, no money in the bank account, barely hanging on until the next payday, another several hundred dollars paid in interest to the credit card companies, and in desperate need of lower monthly payments and just a little financial relief.

Source: nationalnewstoday.com

10 Steps to Get out of Debt

Kelly Whalen is the founder of The Centsible Life, a blog where motherhood and money meet. Her goal is to help readers live well on less. Kelly is a mom to 4, and loves that she can stay at home with her kids, and still pursue her passions for writing, personal finance, and social media. You can often find her on twitter and Facebook talking money and motherhood.

Source: budgetable.com

FREE Kindle Download: How to Get Out of Debt

To find FREE Kindle books, simply visit any category page in the Kindle Store and sort by ?Price: Low to High?. As you click through the categories, your results will stay sorted by price so that you can quickly find free books to download.

Source: truecouponing.com

FAQs of Credit Counselling

With more and more people attempting to live beyond their means, it?s only natural that credit troubles are also becoming more common.? When you get to the point where you can no longer keep up to credit payments and creditors seem to call you several times a day, you have to make a decision.? Most people will try to avoid the ?B? word at all costs, but really aren?t sure of how they should proceed to get their finances back in order.

Source: solveyourdebts.com

Survey: Men and Young Adults More Confident in Getting Out of Debt

As you might imagine, the youngest adults, ages 18-24, are overwhelmingly sure of themselves when it comes to getting out of debt. Three-quarters of young adults feel sure they can and will get out of debt in their lifetime. Not surprisingly, the percentages slid down for older age groups. Just 38.7% in the 55-64 age group believe they will get out of debt during their life.

Source: creditdonkey.com

To Get Out of Debt, It May Help to Think Small

The researchers tested whether closing individual accounts affects a consumer?s likelihood of eliminating their overall debt, regardless of the absolute amount of debt in the closed accounts. To do so, they examined nearly 6,000 consumers in a debt-settlement program, which is a program designed for borrowers who can?t meet the minimum monthly payments on their debt accounts. Participants are required to make a single payment each month to a designated savings account. The debt settlement firm negotiates with the consumer?s creditors to reduce the balance due on the consumer?s debts and the money saved in the accounts goes to pay off the reduced balances. It typically takes several years to pay down the balances.

Source: nytimes.com

Tags: credit card balances, Debt, independent financial adviser, minimum credit card payments, Money

krampus robert de niro winner of x factor cheesecake recipe leona lewis carlos beltran air jordan 11 concord

??

??

? ??

? ?? ??

??

??

?? ??

?? ??

??

??

?? ??

??

In April of 1985 one of the biggest brands in the world made an almost catastrophic blunder. The decision was made to tamper with the famous recipe following the continued success of rival Pepsi?s marketing plan ?The Pepsi Challenge?, which showing alarming signs the public preferred the taste to Coca Cola. Paranoid Chief Executive Roberto Goizueta launched New Coke in an attempt to win over old and new customers alike. This didn?t go to plan.

In April of 1985 one of the biggest brands in the world made an almost catastrophic blunder. The decision was made to tamper with the famous recipe following the continued success of rival Pepsi?s marketing plan ?The Pepsi Challenge?, which showing alarming signs the public preferred the taste to Coca Cola. Paranoid Chief Executive Roberto Goizueta launched New Coke in an attempt to win over old and new customers alike. This didn?t go to plan. In 1982 Steven Spielberg?s film E.T proved a huge success; inevitably, spin-offs began in numerous industries. The burgeoning video games industry wanted in on this, so market leader Atari created an adaptation for their Atari 2600.

In 1982 Steven Spielberg?s film E.T proved a huge success; inevitably, spin-offs began in numerous industries. The burgeoning video games industry wanted in on this, so market leader Atari created an adaptation for their Atari 2600. In 1982 the growing success of video game company Nintendo attracted the attention of movie giant Universal City Studios. They contended the Japanese firm?s popular arcade game, Donkey Kong, was a breach of their copyright for King Kong.

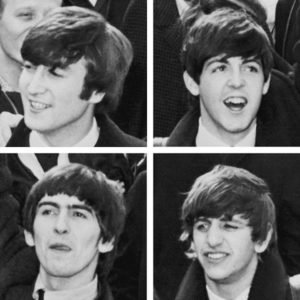

In 1982 the growing success of video game company Nintendo attracted the attention of movie giant Universal City Studios. They contended the Japanese firm?s popular arcade game, Donkey Kong, was a breach of their copyright for King Kong. Decca Records messed up the biggest opportunity in music history, circa 1961.

Decca Records messed up the biggest opportunity in music history, circa 1961. In 2009 AOL parted company with Time Warner after 8 years in a business merger which proved, unequivocally, to be one of the most disastrous in history.

In 2009 AOL parted company with Time Warner after 8 years in a business merger which proved, unequivocally, to be one of the most disastrous in history.